Tender Bid Bond: Understanding Its Importance and Process

A tender bid bond is a critical financial guarantee required in construction tenders, protecting project owners by ensuring that contractors honor their bids and enter contracts upon award. Bid bonds reduce the risk of contractors withdrawing bids or failing to fulfill obligations after acceptance. Typically required in public sector projects and increasingly popular in private projects, bid bonds ensure serious, financially capable bidders, safeguarding the tendering process.

What Is a Tender Bid Bond?

A tender bid bond , commonly known as a bid bond , is a type of surety bond provided by contractors during the bidding phase of a construction project. This bond assures project owners that contractors will:

-

Honor the bid price submitted.

-

Enter into a contract if awarded the project.

-

Provide performance and payment bonds as required.

If contractors fail these obligations, the project owner can claim compensation, usually the difference between the defaulted bid and the next lowest offer. This ensures that only committed and capable contractors participate in bidding.

Why Are Bid Bonds Required in Construction Tenders?

Bid bonds fulfill several critical roles:

-

Ensuring Contractor Commitment: They discourage frivolous bids and deter withdrawal after a bid is selected.

-

Financial Protection: If a contractor defaults, the bond covers additional costs for the owner.

-

Fair Competition: Bonds ensure only serious, financially stable contractors participate.

-

Legal Compliance: Many jurisdictions mandate bid bonds for transparency in public sector projects.

These advantages collectively enhance the reliability and effectiveness of the construction tendering process.

How Much Is a Bid Bond Worth?

The value of a bid bond, known as the penal sum , is typically calculated as a percentage of the total bid amount:

-

5% to 10% : Common for most projects.

-

Up to 20% : Often mandatory for federal and significant public projects.

For instance, a 10% bid bond on a $1,000,000 project equates to $100,000, providing sufficient financial recourse for owners if a contractor defaults.

How to Obtain a Bid Bond

Securing a bid bond involves these essential steps:

-

Select a Surety Provider: Choose a reliable surety company experienced in construction.

-

Application Submission: Provide financial statements, credit history, and past project details.

-

Underwriting Evaluation: The surety assesses your financial stability and project track record.

-

Bond Issuance: Once approved, submit the bid bond with your tender.

Best practice recommends contractors have pre-approved bid bond line facilities , significantly speeding up bond issuance. Contractors must exercise caution with automatically renewable bid bonds , as they entail high risks, potentially obligating contractors indefinitely if not explicitly canceled.

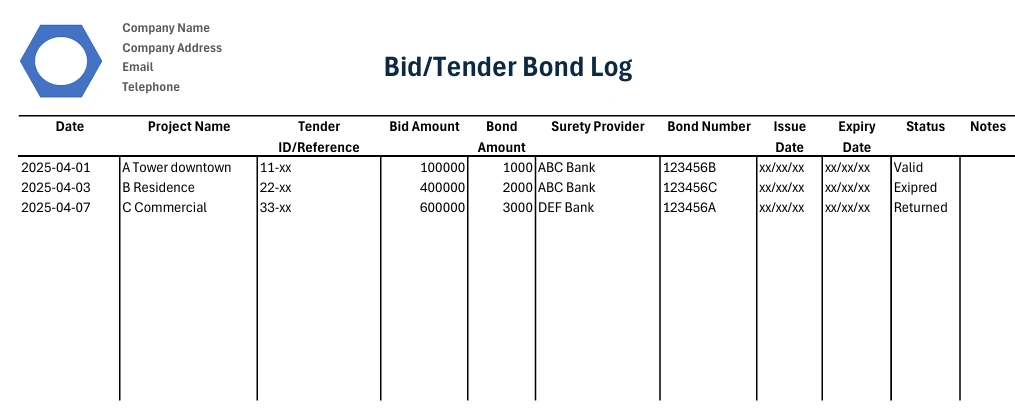

Bid bond / tender bond log

When is the Bid Bond Returned?

A bid bond is typically returned to contractors:

-

After awarding the contract to another bidder.

-

Upon submission and acceptance of performance and payment bonds by the successful bidder.

Once returned, the contractor’s total bonding capacity increases back to the original level, enabling participation in new projects.

Conclusion

Including a tender bid bond in your construction tender demonstrates your financial strength and commitment. It not only protects project owners but also reinforces fair competition. Avoid risks associated with automatically renewable bonds and establish pre-approved bond facilities to enhance your operational efficiency.

Ready to secure your next tender successfully? Engage with an experienced surety provider to secure your bid bond and ensure your competitive advantage.

Download Section

- bid bond tender bond real example

- bid bond tender bond swift sample

- bid bond tender bond template

- bid bond tender bond excel log

- bid bond tender bond pdf log

Ensure templates and logs are customized specifically for your project's unique requirements.

References

-

JW Surety Bonds. "Bid Bond Guide." JW Surety Bonds

-

Investopedia. "Bid Bond: What It Is, How It Works, Vs. Performance Bond." Investopedia

-

Wikipedia. "Bid bond." Wikipedia